It’s March—did you set any financial goals for the new year? How are they going? As we enter a new quarter, it’s not too late to try again, to turn things around, to regroup. For years, I tried to follow the traditional advice on budgeting: track your income, monitor your expenses, and give every dollar a job. But it never worked for me. For one, it’s nearly impossible to predict how much you’ll spend on electricity, natural gas, or water. Sure, you could guess or average it out, but that just leads to more uncertainty.

The Simple Solution: Two Bank Accounts

The solution is straightforward: we use two bank accounts, a method that has proven to work really well for us. Let me walk you through how it works.

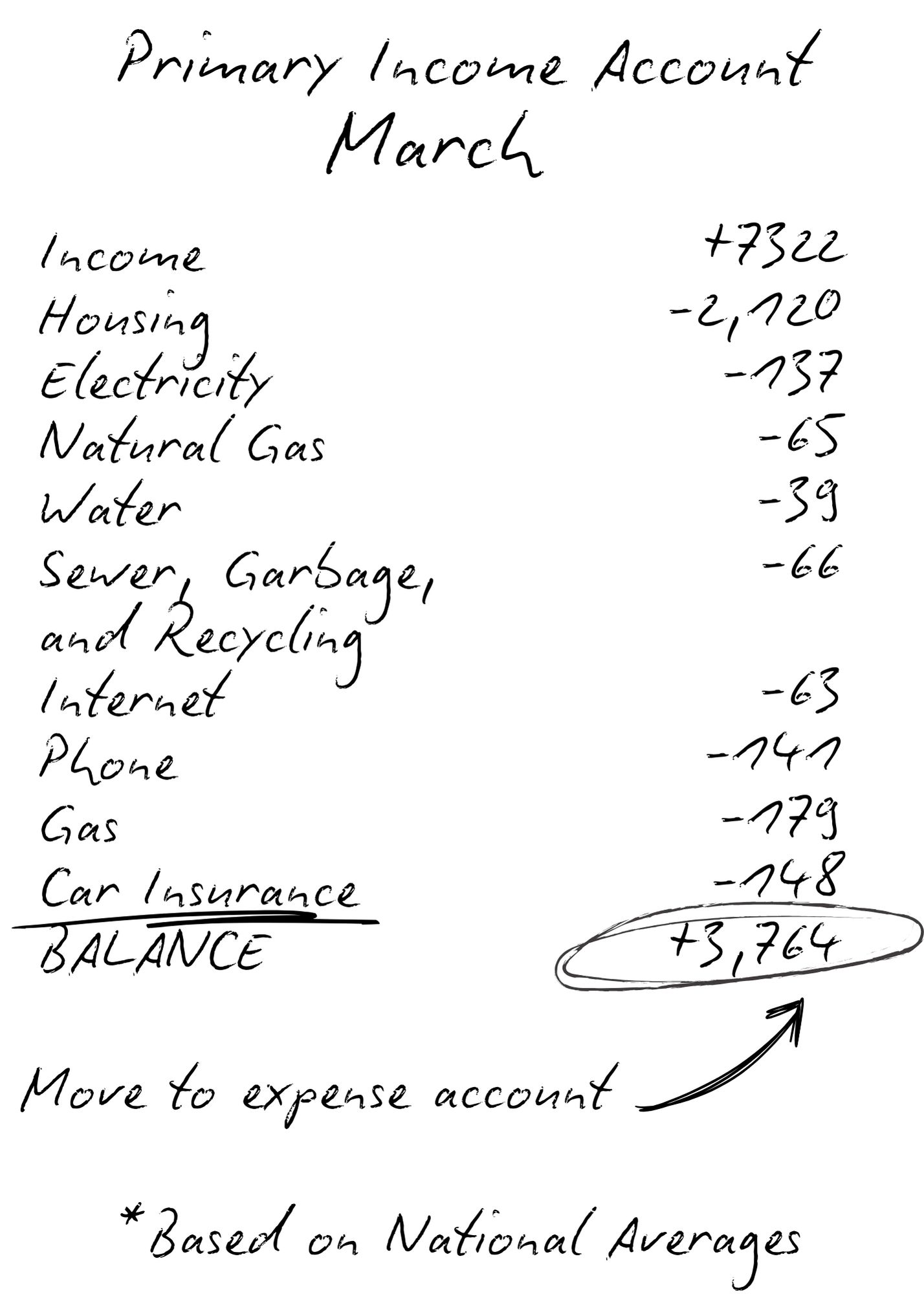

1. Primary Income Account

One account, let’s call it our Primary Income Account, is where our income gets deposited and where all our bills are paid from. Twice a month, our income is deposited, and throughout the month, the bills are paid from this account. Almost all of our bills are set to autopay, and the payments are automatically withdrawn from this account. We withdraw nothing else from this account—not for groceries, not for clothes, and not for emergencies. We do not touch the money in this account.

Tip: If you have a card linked to this account (the one your paycheck is deposited into), do not keep it in your wallet. Store it away safely to prevent temptation.

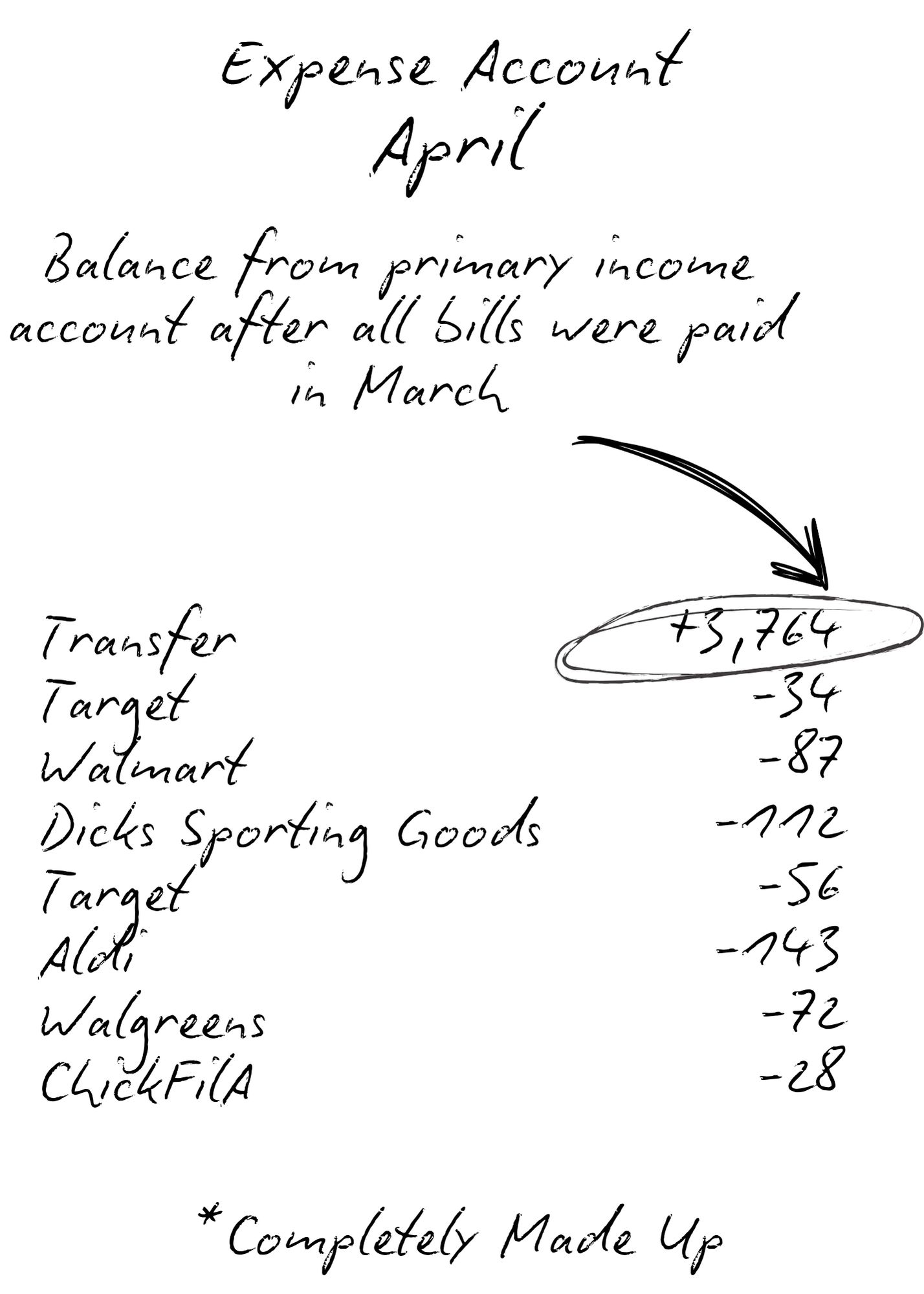

2. Expense Account

On the first day of each month, any remaining balance in the Primary Income Account, after all bills are paid, is transferred to the second account, our Expense Account. (If you’re able to save, move the desired amount to a savings account, and transfer the rest to the Expense Account.) This amount becomes your budget for the month. You can’t overspend as long as you stick to this amount.

Keep the card for the Expense Account in your wallet and use it for groceries, clothes, dining out, or other miscellaneous expenses. Make sure the account has no overdraft protection. The key is that if you exceed your budget, your card will decline, and when that happens, you’ll have to put the item back and return for it later when you have the funds available.

Prioritizing Your Spending

If you find yourself with more month at the end of your money, purchases will need to wait until the next paycheck. To avoid this, at the beginning of each month, I assess the available funds and prioritize based on upcoming needs.

I ask myself:

- Do we have an event to attend where we need to buy appropriate clothing for the family?

- Is someone’s birthday coming up, and do we need to buy a gift?

- Are we going on a trip?

- Are we running low on essentials like shampoo, laundry detergent, or other household supplies?

- Do we need to sign up for swim lessons or other activities?

This helps us focus on what’s important and make sure we allocate funds to the most pressing expenses.

Why This System Works

This approach simplifies budgeting by eliminating the need for guesswork, estimates, and averages. You know exactly how much money you have for the month, and you’re not spending money that’s meant for bills. One account always has a full paycheck in it, designated solely for bills, so I never have to worry about whether there’s enough to cover expenses like the electric bill.

Of course, we have financial goals, and saving goals, and hopes and dreams, and all the rest. But from month to month, this system is one way we ensure we consistently spend less than we earn.